Whenever we apply for a loan, our top priority is almost always to look for the cheapest rates. This is completely understandable as all of us are merely trying to save on some cash and not burn a hole in our pockets.

However, it is crucial to remember that if something sounds too good to be true, it probably isn’t real, or legitimate. For example, a money lender that offers extremely attractive rates but uses high-pressure sales tactics and demands upfront payment.

No one wants to get caught in a loan scam, really. It’s important to ensure that what you’re dealing with is a licensed money lender in Singapore, not an illegal money lender.

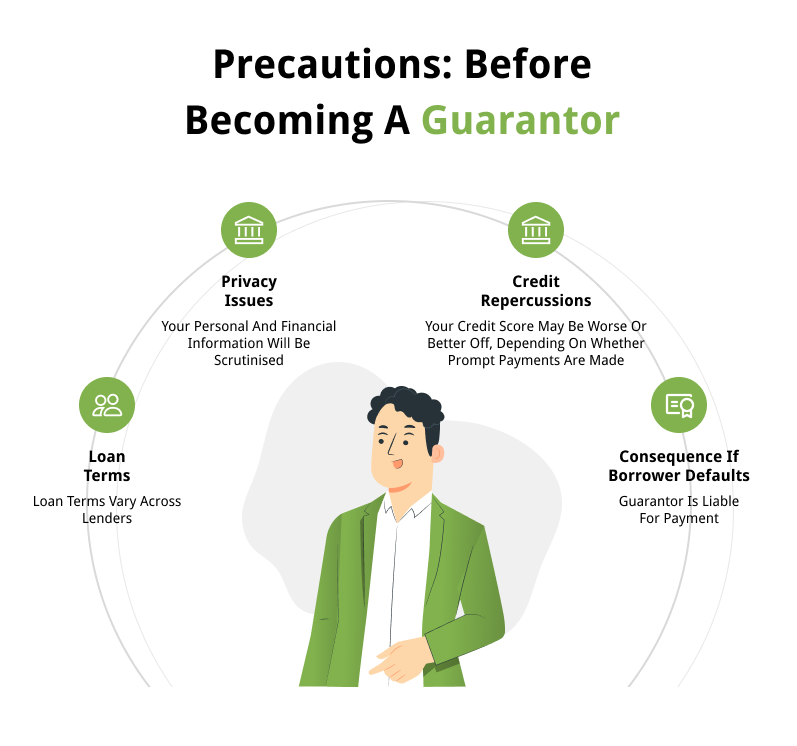

Here are some precautions to take and warning signs to look out for when you apply for a personal loan in Singapore.

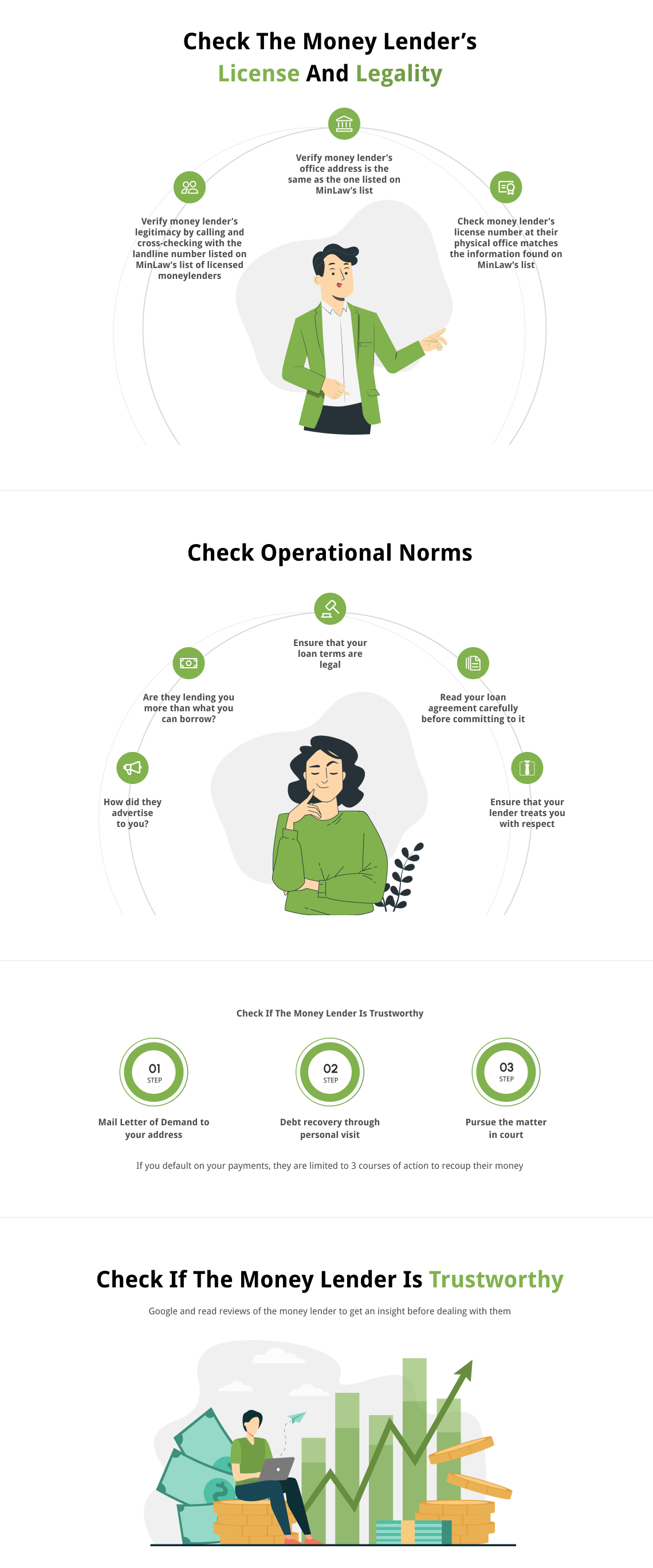

1. Check if the money lender is legal

The easiest way to differentiate a licensed money lender in Singapore from an illegal one is through the Ministry of Law’s Registry of Moneylenders site. This list contains the legal and credible money lenders that are approved by the government.

Take note that every legal lender should have a license number. These money lenders have been approved to manage their business under strict regulations set by the ministry. Before you apply for a personal loan, check your money lender against the list and if you don’t find them there, take that as a red flag.

Another way you can check if your money lender of choice is legitimate is by doing a little digging into their reviews and contact details. Money lenders should have their phone numbers and their business address on their secured websites. These are some of the information that illegal money lenders may leave out as they prefer being untraceable.

2. Pay attention to the required documents for verification purposes

While there are different types of personal loans available, certain documents are always needed when applying for a loan.

Your money lender would require you to submit your income tax statements, payslips, along with your NRIC.

Based on these documents, your money lender officer will determine your loan amount and personal loan interest rate before drawing out a verification document that you will have to sign. While some money lenders may not ask for your credit report when applying for a personal loan, they will always ask for your income statements.

If your lender does not ask for any sort of documentation related to your salary, it is probably a warning sign for you to walk away.

3. Compare with other lenders

A good way to gauge the credibility of your lender is to compare them with other money lenders. If your cheapest personal loan quote seems too good to be true, it probably is. Many illegal money lenders promise the cheapest personal loan interest rates in Singapore, which also come with unreliable protocols. For example, they may demand upfront payment even before processing an application and may even want money to be sent through an untraceable method, such as a prepaid gift card.

Licensed money lenders are not authorised to charge an administrative fee or processing fee to secure the loan before the loan is disbursed.

Another clear warning sign is that unlicensed lenders usually do cold calls or send out unsolicited text messages; legal lenders deal at their physical offices, which are verified by the ministry.

4. Ensure you aren’t being charged extra interest for your loan

While some illegal lenders promise the most hassle-free, cheapest personal loan in Singapore, they may also be trying to charge exorbitant rates without you even realising.

There are laws set in place by the ministry that put a cap on interest rates that licensed money lenders are allowed to charge their clients. For example, licensed money lenders in Singapore are authorised to charge a maximum interest rate of 4% per month. If the interest rate offered is higher than that, cancel your transaction immediately!

Before engaging with a money lender, it is important to do your research and tick off a checklist comprising both red and green flags.

Need a leg-up? Use LoanHere to get free loan quotes from top licensed money lenders in Singapore.