Private Loan Guide: Legal Licensed Money Lender in Singapore

Quick jump to...

QUICK JUMP TO

This is the most complete and updated guide to understanding Legal Licensed Money Lenders in Singapore. Regardless of whether you are:

This is the perfect guide for you.

Here’s what we will be covering in this guide:

Before taking a loan:

Understanding all about licensed money lenders

When applying for a loan:

Requirements, processes and more

After taking a loan:

Everything you need to know about loan repayment

Chapter 1

Introduction to licensed money lenders in Singapore

What are licensed money lenders?

Licensed money lenders are officially listed loan companies in Singapore that carry out the business of moneylending in consideration of a larger sum being repaid. The business is authorised, registered and regulated by Singapore’s Ministry of Law.

All legal money lenders in Singapore need to be registered with MinLaw’s Registry of moneylenders, be approved by MinLaw, follow MinLaw’s guidelines and regulations and abide by the Moneylenders Act. These guidelines are updated with new rules for authorised money lenders in Singapore from time to time.

How are legal money lenders in Singapore different from banks?

There are a few ways to get loans in Singapore, such as borrowing from a licensed money lender or the bank. What’s the difference between taking a loan from a trusted private money lender in Singapore and a bank?

Take a look at our comparison illustration below:

- Bad credit history

- No stable income

- Low income <

- Employed

- Did not default on

What are the pros and cons of taking a loan from licensed money lenders?

Borrowing from legitimate money lenders usually entails unique pros and cons. Some of you might know that legalised money lenders in Singapore have less stringent loan application processes than banks but have higher interest rates.

What are the main pros and cons of borrowing from reliable money lenders in Singapore? We summarise them for you:

What is the Moneylenders Act?

The Moneylenders Act is an Act for the regulation of moneylending, the designation and control of a credit bureau, the collection, use and disclosure of borrower information and data, as well as related matters.

In short, it lists out all the legal confines within which legal private money lenders in Singapore are permitted to conduct their business activities.

According to MinLaw’s list, there are 154 legalised money lenders in Singapore as of time of writing. This figure is not permanent.

Chapter 2

Comparing, choosing and verifying the most reliable licensed money lenders in Singapore

Here’s how you can verify and check the licence of licensed money lenders online

Before you take a loan from a seemingly legitimate money lender, it is very important to check if they are legal and licensed to avoid getting tangled in illegal money lending or money lender scams in Singapore.

How can you thoroughly check on the legitimacy of a licensed money lender online?

1

Check if your local money lender is in MinLaw’s list of registered lenders in Singapore.

2

Not sure if the contact number of the licensed money lender online is genuine? Call their office landline to verify and confirm if you’re dealing with a registered money lender.

3

Ensure the online money lender in Singapore has a physical office. It’s not possible to complete the loan process entirely online when borrowing from a legalised money lender in Singapore. In case you didn’t know, all licensed online money lenders in Singapore must have their borrowers visit their office for a face-to-face verification to complete the loan application process.

Meanwhile, here are some warning signs of a potential loan scam! Do take note of these red flags – you might be dealing with an illegal money lender if you encounter these signs.

Also, do take note of these red flags – you might be dealing with an illegal money lender if you encounter these signs.

Licensed money lenders near me: Where to start in your search for a reliable instant money lender in Singapore?

Searching for a trusted money lender in Singapore? Here’s a list of highly rated, instant money lenders across the various regions of Singapore:

1

Make sure they are under MinLaw’s list of licensed money lenders

First, check whether they are licensed and are part of MinLaw’s list of licensed money lenders in Singapore. If they are, it is safe to proceed to apply for a loan with them.

If they are not, they might be illegal money lenders and we do not recommend using them as you might end up having to pay hefty fees and interests or get harassed by them if you are not capable of repaying your loan.

2

Check reviews of licensed money lenders in Singapore

Before getting a loan from a money lender, scrutinise the money lender’s reviews on Google and other sites, especially verified reviews, to check the quick money lender’s reputation and credibility. It is better to take a loan with a registered money lender that has a higher number of positive ratings.

3

Compare local money lenders’ fees and rates

Approach the licensed money lenders you are interested in taking a loan from and ask about their fees and interest rates. It’s always recommended to compare rates across different legitimate money lenders before deciding on one. With enough searching, you may be able to find the cheapest personal loan.

4

Check their loan contract terms and conditions (T&Cs)

Before you sign the loan contract, remember to check their T&Cs carefully to make sure that all the agreed terms are stated clearly in the contract. If there’s anything that’s unclear, clarify with them. If you feel uncomfortable with any terms that you have not agreed to, you can always walk away and choose another money lender. There are many good and fast money lenders on the market that can provide you with speedy funds.

5

Ensure they are a good fit and are polite when communicating with you

Make sure that the licensed money lender’s representatives are communicating with you politely at all times, regardless of whether you are speaking with them on the phone or meeting them at their office.

6

Check for recent news/stories on licensed money lenders

Sometimes, some money lenders might be in the news due to bad practices – there have been a number of money lender horror stories recently! So, remember to do your research and check if the money lender you are interested in taking a loan from has good records and is not in the news for the wrong reasons.

Chapter 3

Types of loans, interests and fees charged by licensed money lenders

What are the interest rates licensed money lenders in Singapore can charge?

Maximum interest rate licensed money lenders can charge: 4% every month

If you fail to repay your loan on time, the money lender can charge you a maximum rate of late interest of 4% monthly for each month the loan is repaid late.

What are the other fees licensed money lenders can charge?

Licensed money lenders can only impose these additional charges:

Late repayment fee ≤$60 per month of delayed repayment

A processing fee amounting to ≤ 10% of the loan principal at the point of loan granting

Court-ordered legal costs for the successful reimbursement to the licensed money lender for the costs incurred to recover the loan in the event a borrower defaulted on their payment

The total fees charged by an authorised money lender for any loan (inclusive of interest, upfront processing fee, late interest, and late fee) cannot go beyond an amount that is equivalent to the loan sum. Suppose you get a loan of $8,000, the interest, late interest, processing fee and monthly late fee cannot be more than $8,000.

How do licensed money lenders compute their interest rates?

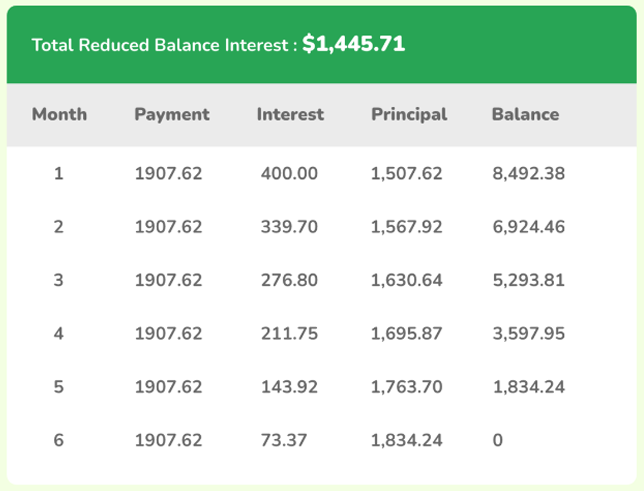

Licensed money lenders’ interest rates are not flat, but are instead reducing. Personal loan interest rates are calculated based on the principal amount outstanding at the end of a specific period.

For example, if you borrowed $10,000 and have repaid $1507.62 of the principal loan amount (not including interest), interest for your next payment will be calculated based on the remaining balance of $8,492.38.

Example

Loan Amount :

$10,000

Annual Interest Rate:

48%

Number of Payments:

6

Annual interest rate = 48%

Per month interest rate = 4%

1st month interest calculation:

$10,000 (Outstanding balance) x 4% (Interest rate per month) = $400

2nd month interest calculation:

$8492.38 (Outstanding balance) x 4% (Interest rate per month) = $339.70

3rd month interest calculation:

$6924.46 (Outstanding balance) x 4% (Interest rate per month) = $276.98

4th month interest calculation:

$5293.81 (Outstanding balance) x 4% (Interest rate per month) = $211.75

5th month interest calculation:

$3597.95 (Outstanding balance) x 4% (Interest rate per month) = $143.92

6th month interest calculation:

$1834.24 (Outstanding balance) x 4% (Interest rate per month) = $73.37

To find the first month interest, multiply the outstanding balance ($10,000) by the monthly interest rate (4%). You will get $400 – this is your first month’s interest.

Next, we will need to calculate the principal amount to be paid on the 1st to 6th month so that we can get the EMI (equated monthly instalment) for the period of 6 months. (In Excel, you can use the PMT function to get the result.)

If you take a look at the interest for the next few months, you will realise that the amount of interest to be paid actually reduces.

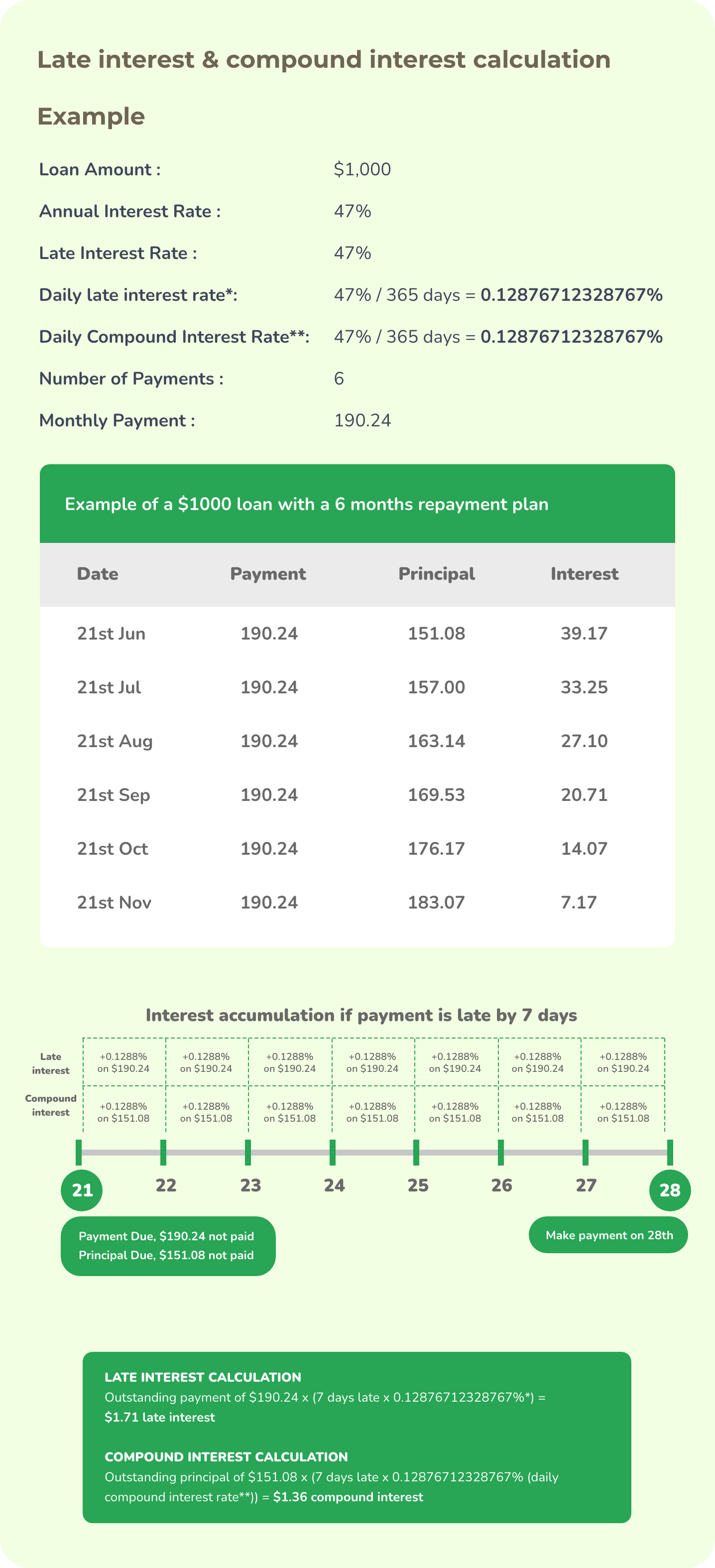

How do money lenders calculate late charges: Late fees, compound interest and late interest?

If you don’t repay your loan on time, you will incur late payment charges from licensed money lenders. These can include late fees, late interest and compound interest.

A licensed money lender must not impose any late fee of more than an aggregate of $60 within a period of a calendar month. A period of a calendar month extends from a particular numbered day of a month up to the corresponding numbered day of the following month less one. Accordingly, the general rule is that the earliest date a money lender may impose the next late fee, if the repayment is still not made, would be the same corresponding date in the next month.

Late interest is accumulated on a daily basis based on an interest rate not exceeding 48% per annum on the overdue principal and/or interest.

Compound interest is accumulated on a daily basis based on an interest rate not exceeding 48% per annum on the overdue principal.

Both late and compound interest can only be charged on the amount that is repaid late, but not on the outstanding loan that is not yet due to be repaid.

What are the usual market practices for loan amount, loan tenure, interest rate and other fees?

Most fast money lenders provide a repayment period of 1 to 6 months. However, there are reliable money lenders in Singapore that will offer a loan tenure that goes up to 12 months. In some cases, they may even let you enjoy a loan tenure that stretches up to 24 months.

The approved loan amount is based on your income per month and is about 1-3 times your salary, charged at a 1-4% monthly interest rate, with processing fees of 8-10% of your loan amount.

What are the different types of loans you can get from reliable money lenders in Singapore?

Personal Loan

Personal Loans are a form of credit that can help you make a large purchase or consolidate your other debts. Lenders will deliver a one-time cash payment to borrowers and borrowers will need to repay with interest over regular instalments. There are many reasons why people take personal loans.

Check out our Beginner’s Guide to Personal Loans as well as the Dos and Don’ts for First Timers Applying for Personal Loans if you are taking a personal loan for the first time. Additionally, check if the loan is valid by ensuring you’re dealing with a registered money lender.

These are the various types of personal loans:

Who can apply for a personal loan?

Most employed Singapore residents can apply for personal loans online through accredited online money lenders in Singapore, such as full-time employees, part-time employees, and self-employed people such as property agents, insurance agents, Grab/ Gojek/ taxi drivers, food delivery riders, etc.

Most foreigners in Singapore can also borrow from licensed money lenders online as long as they are working and residing in Singapore, and can furnish all required documents.

SME Business Loan

Often, to kickstart new businesses, you need capital injection or funding. And sometimes, unforeseen circumstances such as the COVID-19 pandemic might cause many small and medium businesses to run into financial difficulties.

During such times, a financial boost from an SME Business Loan would help to fuel the business operations and help the company tide through this difficult period.

Chapter 4

Loan application requirements and processes

What is required when applying for a loan from licensed money lenders?

What is the maximum amount you can borrow?

For Secured Loans:

Secured loans are protected by an asset, such as a home or a car, which can be used as collateral. This means the lender will hold the title or deed until your loan has been repaid in full. If you default on the loan, the lender will be able to repossess the collateral and sell it to recoup their losses. Examples include Residential Property Loans and Motor Vehicle Loans.

So what are the legal loan limits?

The Total Debt Servicing Ratio (TDSR) framework applies to property loans. Your monthly housing loan repayments — after adding all your other debt obligations like credit card debts, car loan, personal loan, study loan, etc— cannot exceed 55% of your income.

The borrower’s Mortgage Servicing Ratio (MSR), which shows the fraction of their gross income each month that is used for making repayment to every property loan, is capped at 30%. Take note that MSR only applies to a home loan used for buying an HDB flat or an EC (executive condominium) that hasn’t yet passed its minimum occupation period.

The maximum Loan-To-Value (LTV) for vehicle loans, which refers to the amount of loan expressed as a percentage of the purchase price (including taxes and COE price) of the motor vehicle, is 60-70% depending on the open market value (OMV) of the vehicle.

For Unsecured Loans:

Unsecured loans don’t require collateral from the borrower, which means the lender is taking a higher risk to loan money to the borrower. Hence, unsecured loans tend to have higher interest rates and a certain limit to how much you can borrow.

Is your personal information secure with a licensed money lender?

As you will need to submit your personal information and documents when you apply for a loan, some of you might be concerned about whether your information is secure with a licensed money lender.

Licensed money lenders have to adhere to the Personal Data Protection Act (PDPA), so rest assured that your information will be secure if you are dealing with a truly legal money lender in Singapore.

Tips you should take note of when taking a loan from money lenders

When encountering cash flow problems, a loan can help with financial difficulties and ease your financial worries in the short term.

However, it does not mean your financial troubles will be solved in the long run. You still need to do careful financial planning to ensure that you are able to repay your loan on time to avoid the accumulation of late fees and additional interests.

Remember to make careful considerations before taking a loan with private money lenders in Singapore.

Here are some tips you need to take note of before you get down to borrowing from authorised money lenders in Singapore:

1. Ensure you are able to repay the loan on time

When taking a loan from a licensed money lender, it is important to repay your loan on time. Late repayment will cause you to incur late fees and additional interest for late repayment, which can cause your debt to accumulate rapidly. So, make sure to do your financial planning and budgeting well.

Here’s some tips to repay your loan on time. If you need help with financial planning, we can assist you if you apply for a loan with us.

2. Ensure you have a complete understanding of the contractual terms

Before you sign the loan contract, it is crucial that you read the contract carefully before you sign. Ensure that the agreed terms are stated correctly in the contract, which should include:

- Your particulars

- The amount you are borrowing

- Interest rate and fees

- Repayment terms and schedule

- Money lender’s details such as licence number, business registration number, etc.

Your contract should be similar to this sample form on MinLaw’s website.

3. Qualifying for loan

If you do not qualify for a loan, highly rated authorised money lenders in Singapore will usually give you the option of getting a loan guarantor.

4. Be careful of taking multiple loans

If you have an existing loan, you can still take a second loan, subject to approval.

You can loan up to the total maximum borrowing amount, regardless of the number of licensed money lenders you borrow from. However, this is not recommended as it can be stressful to manage multiple loans.

You can opt for a Debt Consolidation Loan from a money lender which helps you save money by reducing the amount of interests you have to pay.

5. Take note of your credit score

Although licensed money lenders will generally allow you to take a loan even if you have a bad credit score, as borrowing from some private money lenders in Singapore often involves minimal credit check, some may still check your credit records with Credit Bureau Singapore (CBS). This will reflect your outstanding loan(s) with banks and other financial institutions, not including licensed money lenders.

If you have a bad credit score and are in a lot of debt, we highly recommend you seek help from relevant organisations before taking another loan and adding to your debt.

6. Beware of illegal money lenders in Singapore

Licensed money lenders have a strict protocol to adhere to and are not allowed to finalise the loan without meeting you face-to-face and signing a loan contract. If they are not on MinLaw’s list of licensed money lenders in Singapore and don’t want to meet you physically, they are likely illegitimate money lenders or scammers.

Also, licensed money lenders are usually not 24-hour money lenders. If you find a 24-hour money lender in Singapore, they are usually illegal. However, there are many licensed online money lenders in Singapore, meaning you can apply for your loan anytime on online licensed money lenders’ loan portals, such as on LoanHere.

Searching for an online money lender in Singapore? Apply for your loan online with us now.

When you are at the licensed money lender’s office, be sure to look for and check their money lender licence certificate. Every licensed money lender will need to show their licence certificate in a conspicuous place.

7. Consider financial assistance schemes by government agencies

If you are facing financial difficulties due to loss of income or employment and are struggling to make ends meet, it may be better to consider financial assistance schemes by government agencies before considering a loan from a licensed money lender, as taking a loan will add to your debt.

Here are some resources where you can find and apply for financial assistance schemes:

8. Take a loan from licensed money lenders only when you don’t qualify for a bank loan

As bank loans generally offer longer repayment periods, lower interest rates and lower late charges than licensed money lenders, it is better to apply for a bank loan first.

Taking a loan from a licensed money lender can be your second option if you don’t qualify for a bank loan. Some private money lenders may have lower interest rates depending on your loan and loan tenure. You will need to compare various money lenders and identify the most reliable money lender in Singapore.

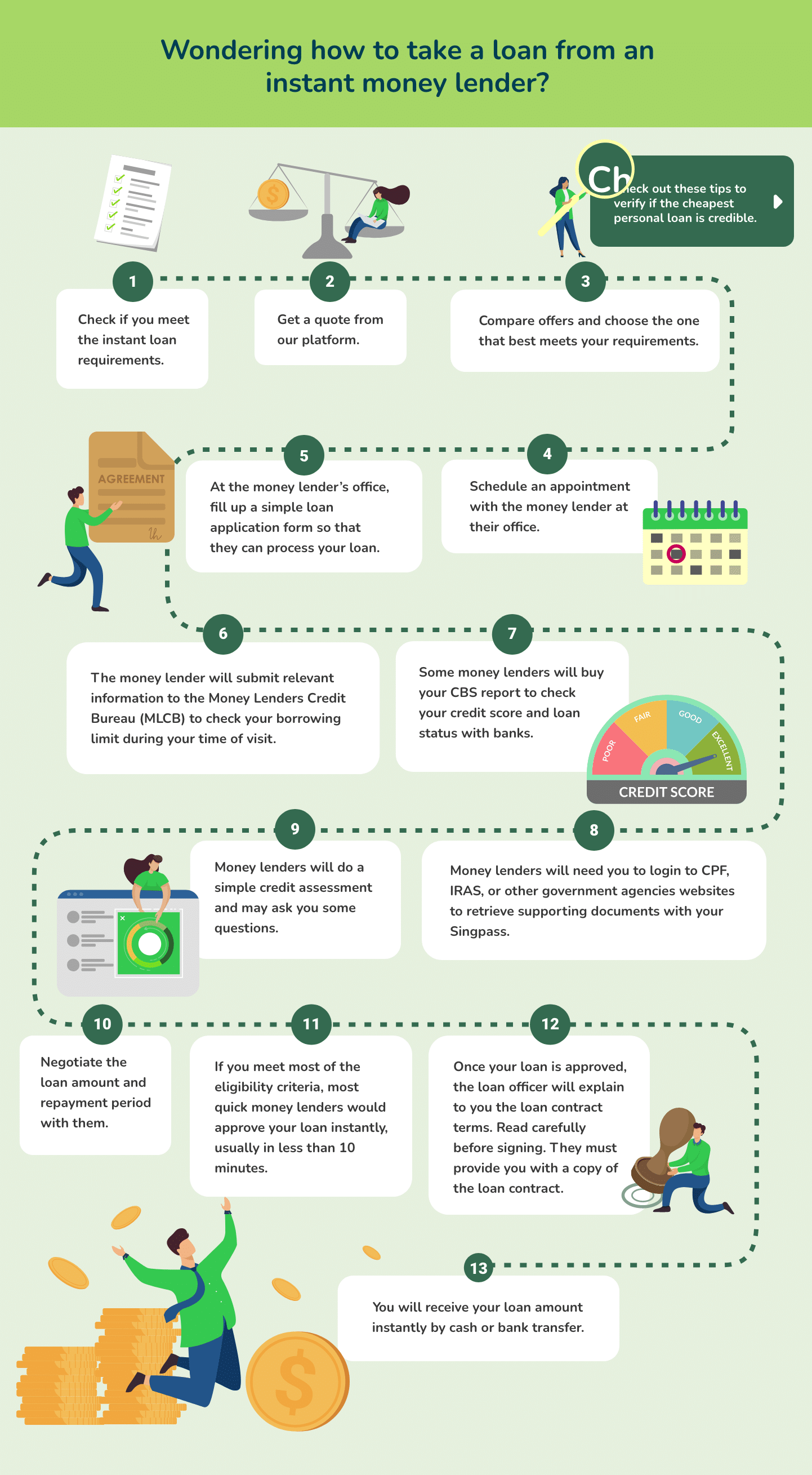

How to borrow from licensed money lenders (Procedure)

What is the Money Lenders Credit Bureau (MLCB)?

The MLCB is a platform that shows borrowers’ existing outstanding loan principal amount with other licensed money lenders in Singapore, total payable amount, repayment records and borrowers’ borrowing limit.

When you apply for a loan with licensed money lenders, they will need to submit relevant information to the MLCB to check your borrowing limit at that time.

Chapter 5

Loan rejection

Possible reasons why your loan is rejected

Although loan applications with licensed money lenders are usually approved easily, there’s still a chance your loan might be rejected due to the following reasons:

1

You don’t have a Singapore home address

Only Singapore Citizens, Permanent Residents and foreigners residing in Singapore can borrow from licensed money lenders.

2

You defaulted on loan repayment from money lenders recently

This represents there might be a risk of you defaulting on your loan with your next money lender, so they may decide not to approve your loan application.

Money lenders will need to check your loan details with other money lenders through MLCB in order to find out your current loan and debt status before deciding if they should approve your loan.

3

You have ongoing litigation

If other licensed money lenders or banks are taking legal action against you for defaulting on loans or if you have other ongoing litigation, it is likely that money lenders may decide not to approve your loan.

4

You are bankrupt or under a Debt Repayment Scheme (DRS)

Usually, when borrowers have accumulated so much debt that they are not able to pay back what they owe, they might declare bankruptcy as a last resort or be placed on a Debt Repayment Scheme. In this case, you will not be allowed to apply for another loan.

5

Inaccurate or insufficient documentation provided

When applying for your loan, ensure that all your particulars and details are accurate and that you’ve submitted all the relevant documentation.

Regarding showing proof of income, even if you don’t have a payslip or CPF Contribution Statement, you can still get a personal loan if you can show your income proof through other documentation.

6

You are unemployed

If you are unemployed and do not have a stable source of income, there is a risk that you may be unfit to repay your loan. So, money lenders may decide not to approve your application.

7

You had applied for multiple new loans recently

This can mean you might have difficulties repaying all your debt. Also, if you have reached the maximum borrowing limit, you will not be able to apply for any more loans.

8

You have multiple loans and your salary cannot sustain them

If your salary is insufficient to repay all your current multiple loans, it may be tough for the next money lender to approve your application.

Chapter 6

Things to note when repaying your loan

Loan Repayment Tips

After successfully borrowing from a licensed money lender and getting the necessary funds, the next step is repaying your lender. So, how do you do it and what should you take note of? When repaying your loan, remember to check these details carefully:

1

Repayment frequency

The loan repayment frequency may be different for different money lenders. It can be a weekly, bi-weekly, a single-payment payday loan or monthly loan with money lenders depending on your loan contract and agreement.

When your payment is due, most of them will send out a payment reminder. But it’s recommended to set your own personal reminder just in case. Late repayment will incur late fees and late interest. This can cause your debt to add up.

2

Payment methods

Available repayment methods to licensed money lenders include cash, interbank transfer and cheque.

3

Send proof of repayment each time you make payment

Each time you make payment for your loan (such as every month, etc, depending on your repayment cycle), remember to keep the payment receipt and send it to the licensed money lender as proof that you have paid.

4

Receipt needs to be issued within 7 days

Every time your repayment has been made, the money lender also needs to send you a receipt either by mail or digitally (such as through SMS, email or WhatsApp) within 7 days after the loan repayment has been made. The receipt will show the outstanding amount until the loan has been repaid in full.

If you did not receive the receipt after you made the repayment, remember to request for one.

5

Check the outstanding loan amount, request for a Statement of Accounts (SOA)

You can request an SOA to check your outstanding loan amount and outstanding repayment sum. A trusted licensed money lender will automatically send you an SOA every 6 months.

6

Take note of outstanding payment

Usually, the outstanding payment would be included in the receipt after you have made your monthly repayment. Some online money lenders in Singapore allow you to access it through their portal online. Alternatively, you may check with them directly.

After you have repaid your loan in full, and if you have no more arrangements with the money lender, you will no longer receive any calls, emails, mails, SMS or any other form of communication from them regarding your fully paid loan.

What can you do if you are not capable of repaying money lenders in Singapore?

Taking a loan may help you with better cash flow in the short term, but it does not mean solving your financial problems in the long run. Even after taking a loan, it is important to manage your cash flow to ensure that you are able to make the repayment on time and that your debt does not accumulate.

Here’s some tips on how you can stay on budget while managing your loan. Remember to manage your finances wisely.

If you really can’t repay your loan, you can do the following:

1

Request for a payment extension

It is best to approach your licensed money lender and negotiate with them a realistic payment extension deadline that you can meet. Make sure you do your budgeting and financial planning well to ensure that you can really make the payments on time by the new deadline.

2

Get support from social service agencies:

If you are struggling to manage your finances and debt, and if these are causing you a lot of distress, please considering getting help from these social service agencies here for credit counselling and debt management.

Adullam Life Counselling

- Address: 151 Chin Swee Road #08-04 Manhattan House Singapore 169876

- Tel no.: 6659 7844

- E-mail: [email protected]

- Address: 1 Pasir Ris Drive 4 #05-11 Singapore 519457

- Tel no.: 6416 3960

- E-mail: [email protected]

- Address: 1 Jurong West Central #06-02 Jurong Point Shopping Centre Singapore 648886

- Tel no.: 6416 3990

- E-mail: [email protected]

- Address: No. 5 Harper Road #02-01A Singapore 369673

- Tel no.: 6909 0628

- Email: [email protected]

- Address: 16 Arumugam Road #04-02B LTC Building D Singapore 409961

- Tel no.: 8428 6377

- Email: [email protected]

Credit Counselling Singapore (only when you also have bank loan debts)

- Address: 51 Cuppage Road #07-06, Singapore 229469

- Tel no.: 6225 5227 / 6338 2663

- Email: [email protected]

- Address: 8 New Industrial Road #04-04B LHK 3 Building Singapore 536200

- Tel no.: 6547 1011

- Email: [email protected]

Silver Lining Community Services

- Address: 11 Playfair Road Singapore 367986

- Tel no.: 6749 0400

- E-mail: [email protected]

3

File for bankruptcy

If your debt has amounted to at least $15,000 and if you are still not able to pay back your loan despite countless payment extensions, filing for bankruptcy may be an option for you.

When you file for bankruptcy, the accumulation of loan interest stops and money lenders will also not be able to carry out legal proceedings against you.

However, filing for bankruptcy comes with serious consequences (such as having your assets sold to repay your debt) and it should be your last resort.

Chapter 7

Licensed money lenders debt collection

What can licensed money lenders do if you default on the loan?

Usually, when borrowers default on their loans, licensed money lenders would hire debt collection agencies to collect the debt from borrowers.

Although there are currently no laws in Singapore that regulate debt collection, professional licensed money lenders and debt collectors need to adhere to the code of conduct and good practices set by MinLaw.

Legal money lenders in Singapore will also need to bear the consequences if debt collection agencies use illegal means to collect debt from borrowers, such as using violence, harassment, etc.

They will usually try to collect the debt through these methods:

1

Send a Letter of Demand (LOD) to you by post to your residential address

2

Visit your home or office to recover the debt (either directly or by sending debt collection agencies to do so)

3

File for litigation against you (yes, money lenders can file a case in court)

How can you settle disputes with licensed money lenders?

Sometimes, when the money lender or debt collector turns up at our doorstep or calls us due to late repayment, some borrowers might panic or get upset.

Here are some tips on how you can settle conflicts with money lenders:

1

Try to resolve the conflict by empathising with the debt collector or money lender and react in a calm, non-defensive and respectful manner.

2

Try to negotiate for a compromise – an extension of the repayment deadline that is reasonable to you as well as to the money lender.

3

If you are unable to control your emotions or are having difficulties negotiating, get someone else (a family member or friend) to help mediate or negotiate for you.

4

If negotiations fail or if the situation gets ugly, call the police.

What can you do if you encounter licensed money lenders’ harassment?

Lawful licensed money lenders are expected to adhere to the code of conduct and good practices implemented by MinLaw; they are not allowed to use violence, harassment or intimidation to collect the money owed by borrowers.

What are some common illegal acts of harassment by money lenders?

- Harassing borrowers with multiple SMSes/calls.

- Making multiple calls to the borrower’s home and office, causing distress to their family and colleagues.

- Contacting borrowers during unusual hours.

- Visiting the borrower’s home and workplace multiple times or during unusual hours.

- Loitering around the borrower’s home and office to wait for the borrower.

Common threats money lenders might use to get you to pay up

Are the money lenders threatening you? Here are some common tactics they use:

- Warn borrowers they can make them lose their job if they don’t pay up.

- Tell borrowers they will be going to their home or office to seek payment from their family members or colleagues.

- Tell borrowers they will inform their family members or colleagues that they defaulted on their payment.

- Warn borrowers that something bad will happen to them or their loved ones if they don’t pay up.

- Threaten to beat the borrower up.

If you encounter harassment or disputes by money lenders, you can seek help in the following ways:

1

Call the police

2

Make a complaint against the money lender with the money lenders’ association, Credit Association of Singapore (CAS)

3

Make a complaint with MinLaw’s Registry of moneylenders through their online form

4

Make a complaint with the relevant social service agencies:

Adullam Life Counselling

- Address: 151 Chin Swee Road #08-04 Manhattan House Singapore 169876

- Tel no.: 6659 7844

- E-mail: [email protected]

- Address: 1 Pasir Ris Drive 4 #05-11 Singapore 519457

- Tel no.: 6416 3960

- E-mail: [email protected]

- Address: 1 Jurong West Central #06-02 Jurong Point Shopping Centre Singapore 648886

- Tel no.: 6416 3990

- E-mail: [email protected]

- Address: No. 5 Harper Road #02-01A Singapore 369673

- Tel no.: 6909 0628

- Email: [email protected]

- Address: 16 Arumugam Road #04-02B LTC Building D Singapore 409961

- Tel no.: 8428 6377

- Email: [email protected]

Credit Counselling Singapore (only when you also have bank loan debts)

- Address: 51 Cuppage Road #07-06, Singapore 229469

- Tel no.: 6225 5227 / 6338 2663

- Email: [email protected]

- Address: 8 New Industrial Road #04-04B LHK 3 Building Singapore 536200

- Tel no.: 6547 1011

- Email: [email protected]

Silver Lining Community Services

- Address: 11 Playfair Road Singapore 367986

- Tel no.: 6749 0400

- E-mail: [email protected]

However, if you encounter unlicensed money lenders’ harassment, call the police immediately.

LoanHere can help you suss out the best money lender loan out there for your unique needs

Getting a loan from a legal money lender can help to ease your cash flow, especially during emergencies. However, remember to do your due diligence to check that the instant money lender you are borrowing from is legal and licensed. While you’re at it, do your budgeting well to avoid incurring late fees and charges.

If you are experiencing difficulties, LoanHere can assist you with your financial planning and help you find a trusted money lender in Singapore that provides loans suitable for your needs.

Related Posts

- 4 min read

- 3 min read

- 4 min read

- 4 min read