Singapore’s financial services industry has a sterling reputation, playing host to banks, asset management firms, and other companies from around the world. Locally, licensed moneylending by legal money lenders is more than reputable too.

Legal money lenders here are regulated stringently, with a money lender licence acting like a golden ticket. Currently, there are over 150 companies with a money lender licence. This is a true mark of credibility. However, this also begs the question: Why is a money lender licence so important?

Read on to learn more, and find out how to check a money lender licence from a firm and ensure it’s legitimate before taking on a loan.

Why is a money lender licence important?

A money lender licence is crucial for companies who want to do business by accepting loan applications and disbursing funds. If an aspiring lender doesn’t have it, they are generally not allowed to do business. There’s a set of rules and regulations for licensed lenders in the Moneylenders Act as well.

And as mentioned above, a money lender licence is a badge of credibility. The Ministry of Law requires applicants to take the Moneylender’s Test and fulfil several requirements before they can start operating.

Also, the licence is only valid for 12 months, which means it has to be renewed fairly regularly. This is “subject to the good conduct of the licensee”, according to the Ministry.

Where can I find a list of licensed lenders in Singapore?

The full list of licensed lenders in Singapore can be found online. Rest assured that the Registry of Moneylenders updates this frequently.

As of August 2025, there are 153 licensed lenders in the Lion City, with none being suspended. Here are the details you can expect to see for each company:

- Business Name (e.g. ABC LENDING PTE. LTD.)

- Business Address (e.g. 123, ORCHARD ROAD, #01-01, SINGAPORE 123456)

- Licence Number (e.g. 1/2024)

- Landline Number (e.g. 6123 4567)

- Business URL (e.g. https://abc-lending.com.sg), if any

This list is crucial as it prevents loan applicants from getting caught up with any money lender scams or illegal loan providers. If a company isn’t on the list, avoid it. Even if its staff are able to show you a licence, err on the side of caution and approach another firm as this may be a counterfeit copy.

How do I check a money lender licence to ensure it’s legitimate?

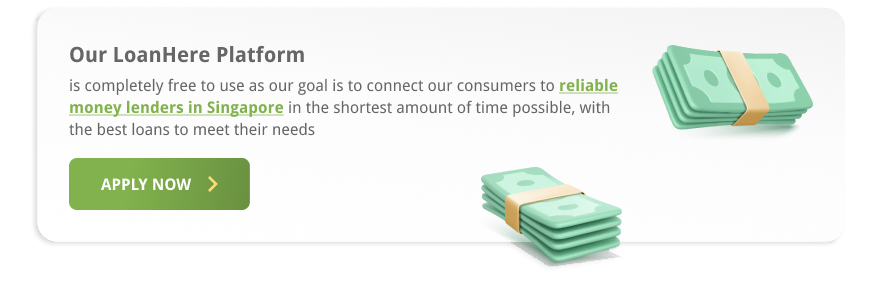

Here’s how to check a money lender licence when you’re scrutinising the document:

- Before you check a money lender licence, ensure it’s displayed in the company’s business premise, or that the staff are willing to let you take a look at it.

- Check that the licence’s details are identical to what you see in the Ministry of Law’s list of licensed lenders. The Ministry even notes down the different business premises a lender has, and all websites which belong to them.

- If you want to be doubly sure of the company before taking up a loan, contact the Credit Association of Singapore and verify that the firm is a member. Being an Association member holds them to higher ethical standards.

However, there’s also a list of over 30 exempt lenders who hold a certificate of exemption from the Moneylenders Act. Fret not, because they, too, are required to extend the validity of their certificate when it nears expiration. These are the only other firms you should be taking up a loan from.

Don’t trust any lender without a valid money lender licence

It is always good to be wary of money lender scams and illegal lenders to be on the safe side of things. Do not trust a lender that tries to explain or give excuses for why it’s not on the Ministry of Law’s list of licensed lenders!

What else should I do before committing to a loan?

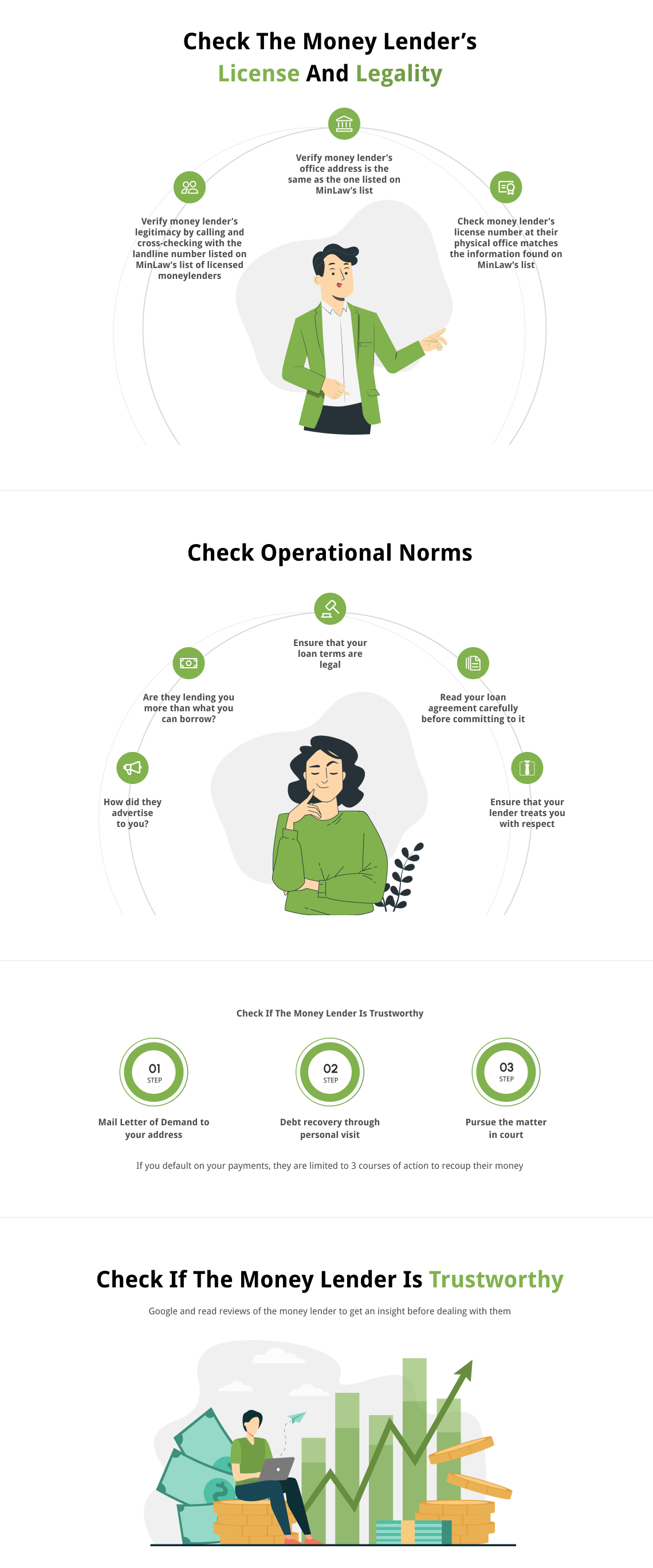

Apart from checking a money lender licence from the loan company you’re interested in, obtain a loan quote across multiple firms. You aren’t obliged to commit to any quote or make a deposit to secure the rates displayed. This lets you compare between lenders and make the best decision for yourself — crucial for properly manage your finances.

While you’re at it, do some research on the lenders by looking at their money lender reviews submitted by fellow borrowers past and present. Gather feedback from friends and family, too.

The ideal loan should be fair and reasonable, and allows you to immediately resolve the financial emergency you’re facing while staying comfortably within your budget for repayment. The less you pay in interest and other fees, the better it is for your finances.

In closing

Because of how regulated Singapore’s money lending industry is, it minimises the chance for bad actors to prey on borrowers. There are clear guard rails to help folks out, including publicly posted FAQs and lists of licensed firms.

Now that you know how to check a money lender licence, you can apply for a loan with confidence if you need one to tide over an emergency situation.

Should you require a loan urgently and need a quote swiftly, look no further than Loanhere. You can receive multiple loan quotes in no time at all from our curated list of licensed lenders in Singapore — simply submit the form online. Be sure to compare and select the one that fits your needs best.