Trust is essential in any relationship, whether it is a personal or commercial one. It is especially crucial in matters that involve money. Anyone who intends to take a loan must ensure that they are dealing with a legal and reliable lender. It is not as simple as reading a money lender review but involves a host of other precautions as well.

This is because irregularities occur despite Singapore’s strict money lending laws and regulations. In some of the more shocking cases, a child as young as twelve and a teenager aged fourteen have been arrested for involvement in illegal money lending activities.

Even legal money lenders have been caught flouting the law. Investigations revealed that the lender had deliberately omitted necessary information such as the loan principal and interest rate from the loan agreement. Money lenders are required by law to include this crucial information in the loan contract before borrowers sign it – so if you intend to take a loan, it’s important to take note of this.

Some of the basic relevant laws that every prospective borrower should know are:

- Money lenders need to be licensed to operate their businesses legally, so when you are at their office, remember to check that their license certificate is displayed.

- Licensed money lenders must be registered with the Ministry of Law, abide by its guidelines and regulations, and adhere to the Moneylenders Act. (Note that these guidelines are regularly updated)

The trustworthiness of money lenders depends mainly on their adherence to the money lenders’ laws and regulations.

What is the Moneylenders Act?

The Moneylenders Act is a set of legislations enacted to regulate the Singapore legal money lending industry. Within it are all the legal requirements and guidelines to which every licensed money lender must adhere.

The Act also specifies that the Moneylenders Credit Bureau (MLCB) shall oversee the industry by maintaining a database of borrower data and other relevant information. The MLCB shares this information when a borrower makes an application for a loan from a licensed money lender registered in Singapore.

How to ensure that your money lender is licensed and can be trusted?

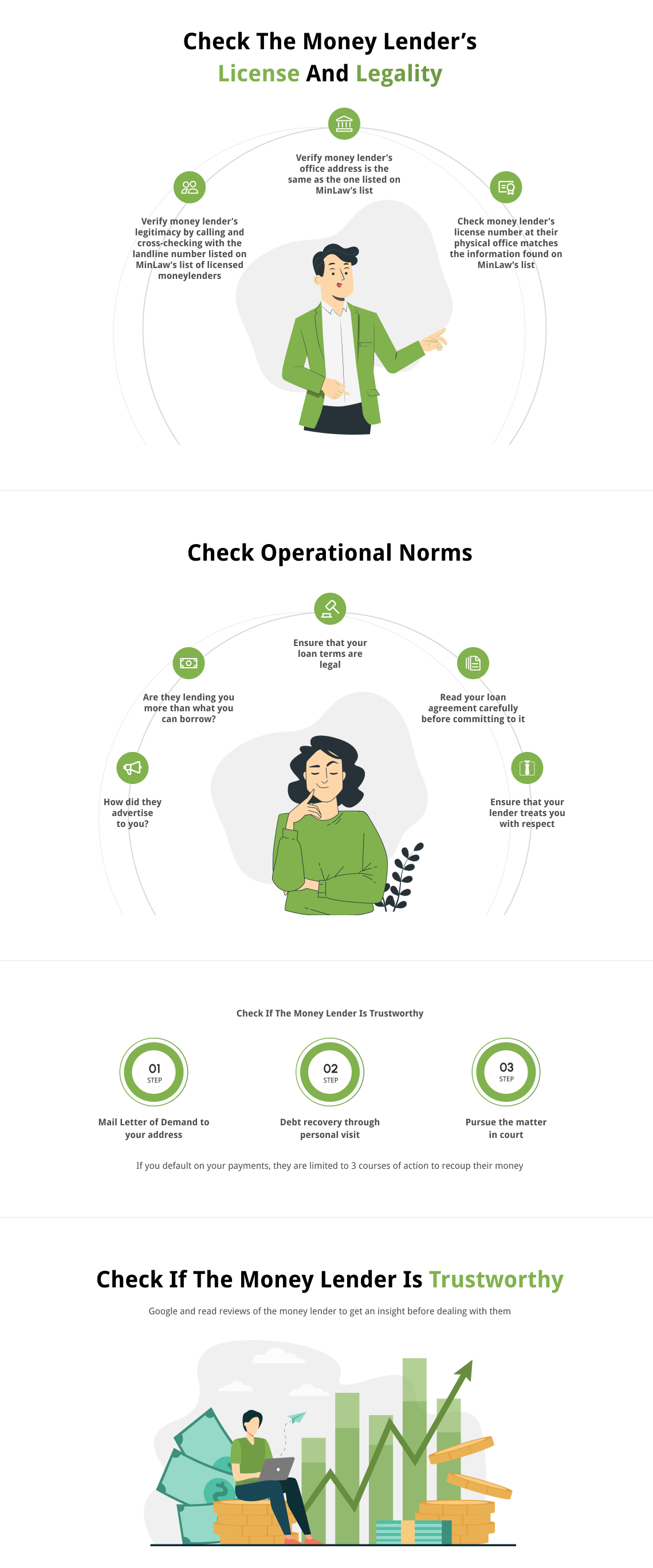

There are three main elements to ensure that you select the right money lender. The first is licensing, which tells you that the company is a legal entity registered with the government. The second is their operational norms, which are indicative of their professionalism. The last is trustworthiness, which you can verify with information from a moneylender review or similar testimonials.

Check the money lender’s license and legality

The official list of licensed money lenders in Singapore can be found at the Registry of Moneylenders on MinLaw’s website. However, that is only the first step. You should also follow up with these precautions:

- Call the money lender’s office landline listed on MinLaw’s list to check if they are indeed the lender. Sometimes, there are illegal money lenders who give themselves the same name as a registered business. However, they list their number to dupe unsuspecting clients into contacting them instead of the legitimate business.

- Verify that they have a physical office at the address listed on the Ministry of Law’s register. This is because the law prohibits any official loan approval without face-to-face verification as a means to combat financial fraud and identity theft. A lender may offer applicants tentative approval online or over the phone, but the loan contract must be signed in person.

- When you visit the money lender’s office, you must see their license certificate displayed.

Check operational norms

- How did they advertise to you?

Licensed money lenders are given a strict set of advertising guidelines to follow. Their ads may only appear in business or consumer directories in print or online, on their websites, or outside their registered offices. Unsolicited SMSes and email messages, flyers, and cold calls are not legally permitted. - Are they lending you more than what you can borrow?

It may seem as if they are doing you a favour, but be wary of anyone who offers you large loans despite your financial circumstances. The law has strict limits on the amount of cash a person may borrow at a time.For example, if you are a Singaporean or Permanent Resident and earn less than $20,000 a year, you can only borrow up to a total of $3,000 (regardless of the number of licensed money lenders you are taking a loan from, this is your borrowing limit). More detailed criteria can be found here.

- Ensure that your loan terms are legal

Ensure that the loan interest rate, late payment interest rate, and the fees and charges listed in the loan agreement fall within the limits set down by law. The maximum interest that can be charged on the loan and overdue payments is 4% a month each.Loan approval fees are capped at 10% of the loan principal, and late payment fees cannot exceed $60 per month.

- Read your loan agreement carefully before committing to it

Before you sign on the dotted line, read the loan agreement carefully, including the fine print no matter how tedious it may seem. Ensure that all the necessary information such as interest rates, fees and charges, loan term, due date, etc, are clearly specified and within legal limits. - Ensure that your lender treats you with respect

Licensed money lenders are required to follow a code of conduct set by MinLaw that treats all borrowers with dignity and respect. This is regardless of whether you are keeping up with payments or have fallen behind.

If you default on your payments, they are limited to 3 courses of action to recoup their money:

- Send a Letter of Demand (LOD) to you by post to your residential or office address.

- Visit your home or office to recover the debt themselves or through a certified debt collection agency.

- Pursue the matter in court.

If they harass you, you can call the police or file a complaint with the Ministry of Law.

Check trustworthiness – money lender review

A money lender review is a quick and easy way to gauge the trustworthiness of any legal money lender. You can find them online such as on Google reviews simply by searching for the lender’s business name. These reviews give you an insight into how other customers feel after having dealt with them.

Before taking the leap

With this post, you have all the basic information you need to identify a trustworthy money lender in Singapore. However, criminals are always changing their modus operandi so you should remain vigilant. We also wrote this article to show you how to identify the most common loan scams.

LoanHere is one of the most established and trusted legal loan aggregators in the industry. We don’t offer you loans but rather bring you the best offers from established legal Singapore money lenders and help you compare their rates and terms.

Save yourself hours of searching and avoid the risk of scams. Get a loan quote from us now.